Th following is Current Real Estate Market Information from The Gosselin Group:

There are a lot of questions on everyone’s minds right now. During challenging times, it helps to have facts, statistics, and listen to varying perspectives.

We feel it is our duty to help keep you informed on real estate matters amid COVID-19. To make the information easier to sift through, we have created a table of contents of some FAQs.

Feel free to scroll down below to the section that is relevant to you.

Market Update

- What does history tell us about pandemics?

- Are people still buying homes?

- What happened in previous recessions?

- Collection of slides provided by www.keepingcurrentmatters.com and www.otteau.com.

Buying a Home

- Is it possible to buy a home right now?

- Can I tour a house without leaving my home?

- Am I missing out if I don’t buy now?

- Should I be investing?

Selling a Home

- Can I still sell my house during COVID-19?

- Can I show my house virtually?

- How can I best use this time to prep my home for sale?

Finances & Economic Package

- Why are mortgage rates fluctuating?

- What kind of temporary housing assistance is there?

- Is now a good time to refinance?

- How can I protect my credit score?

- What are the details of the new Disaster Relief Government Package passed by Congress? How does it impact me and / or my business?

Adjusting to Our New Normal at Home

- Take on some “home projects” to refresh your space

- Learn how to keep toys organized

- Keep local businesses in mind

- Stay Connected with your Network

- Learn New Things / Work on Yourself

*When it comes to learning about COVID -19, you should look to the Centers for Disease Control and Prevention (CDC) or the World Health Organization (WHO) for the most reliable information.

Market Updates

What does history tell us about pandemics?

Many are calling this pandemic an “event”, from which we will recover. Researchers have been taking a deep dive into the economic effects of previous global pandemics to offer some perspective on the current one.

During the 1918 influenza and the 2003 SARS pandemics, economic activity fell sharply, but snapped back quickly once the pandemic was over. The rapid fall and rebound associated with those pandemics differs from a standard recession in which economic activity falls for six to 18 months, and then recovers more slowly.

During the 2003 SARS pandemic, home prices in Hong Kong did not fall significantly, but transaction volume did.

Precisely forecasting the economic effects of COVID-19 is complicated by the uncertainty around the virus’ spread, the policies adopted to control it and how those two things might interact with pre-existing recession risks that existed at the start of the year.

Are people still buying homes?

People have all kinds of reasons for moving and may not have a choice about the timing. While some might postpone buying right now, the New York Times reports that some buyers see opportunity in buying, given the low rates and relative lack of competition for what continues to be tight inventory in for-sale homes.

We are feeling this in our local market in Northern New Jersey, where we service most of the train line towns and corridors. In just the past week our team has had 3 closings, 2 home inspections, 1 appraisal, 1 property go under contract and 2 buyer tours of vacant homes (with social distancing protocol in place) and our very first virtual public open house on Facebook Live this Sunday. There is real estate activity and vendors tied to our industry are moving things along and many have found ways to do it virtually, as we have.

Jeffrey Otteau, New Jersey real estate market authority and president of The Otteau Group often mentions the 9:1 multiplier. Every 1% (100 basis points) drop in mortgage rates lowers debt servicing costs, increasing home purchasing power by 9%, creating a windfall for would-be buyers. See below the example how buyers can afford a home higher valued home without increasing their monthly payment: (Slide courtesy of Jeffrey Otteau Spring 2020 Market Workshop)

You can also check out this NYT article: Buying a Home During a Pandemic.

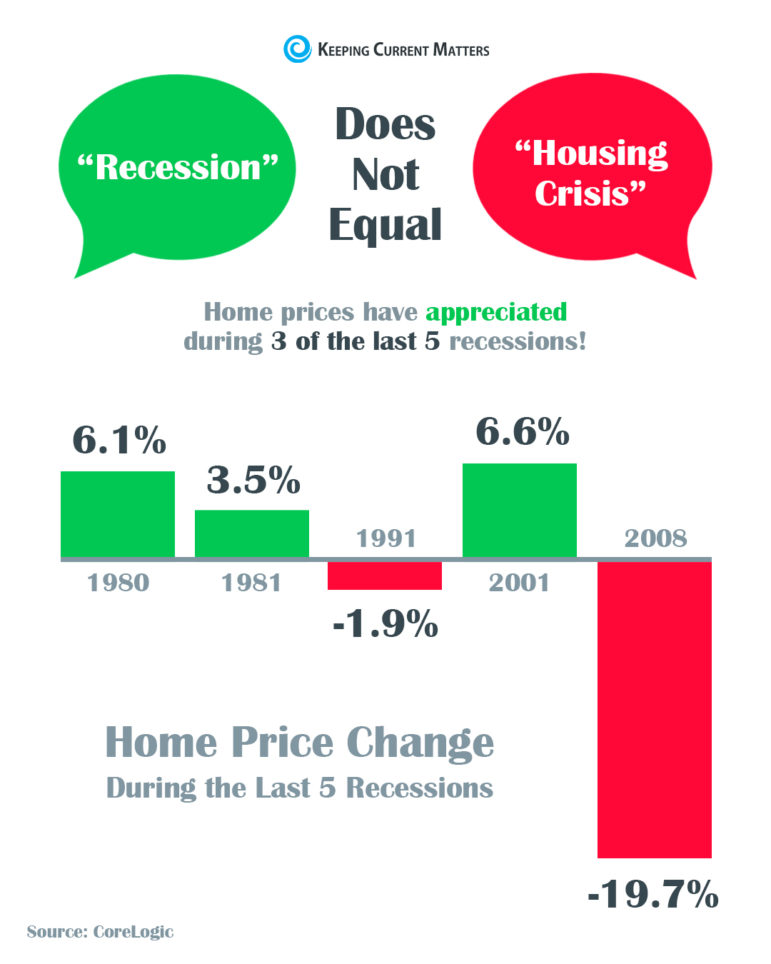

What happened in previous recessions? How is it different this time?

Amid the Coronavirus, there is much talk about the prospect of a recession. I want to give a shout out to Keeping Current Matters for all the resources they are putting forth in contribution to this discussion and I encourage you to read a few of their recent blogs / research:

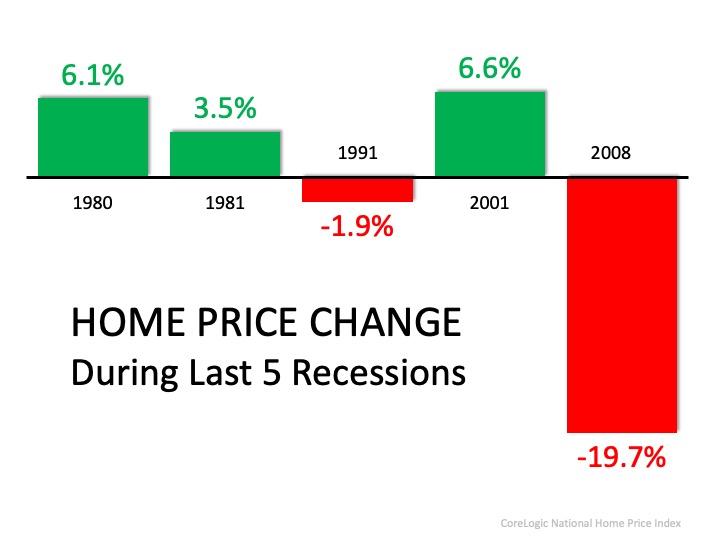

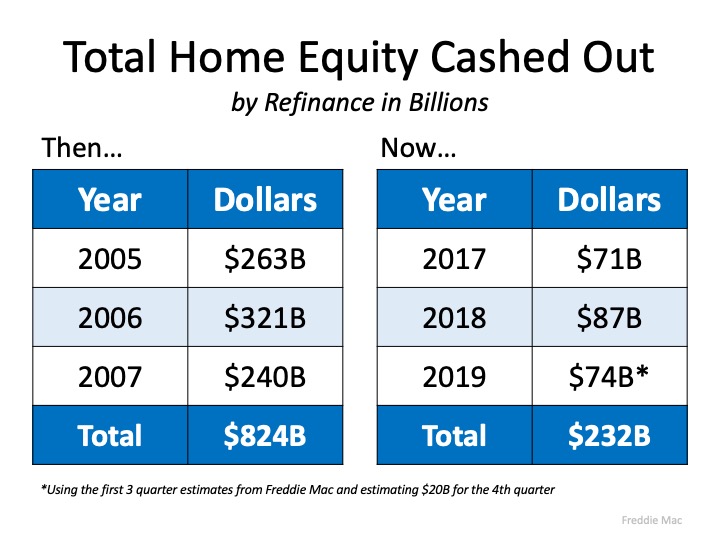

According to KCM – what is taking place today is nothing like what happened the last time. Their article 5 Simple Graphs Proving This Is NOT Like the Last Time states the S&P 500 fell by over fifty percent from October 2007 to March 2009, and home values did depreciate in 2007, 2008, and 2009 – but that was because that economic slowdown was mainly caused by a collapsing real estate market and a meltdown in the mortgage market.

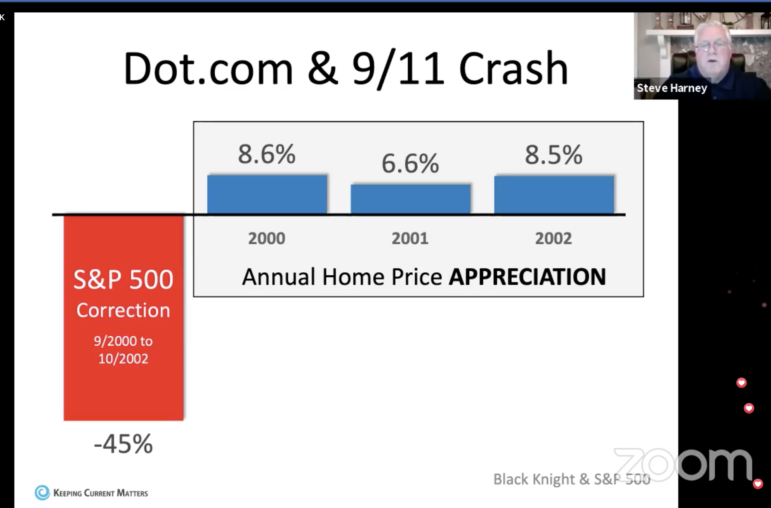

This article by Keeping Current Matters about the link between recessions and home values states that this time, the stock market correction is being caused by an outside event (the coronavirus) with no connection to the housing industry. Experts are saying the current situation is much more reminiscent of the challenges we had when the dot.com crash was immediately followed by 9/11.

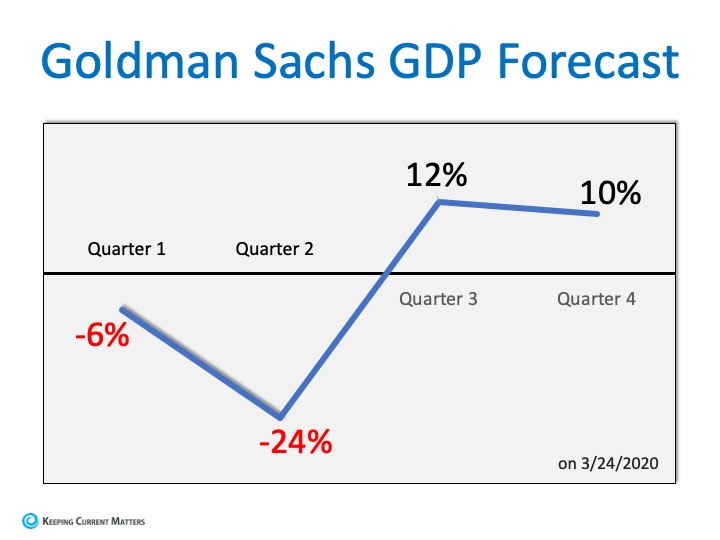

No one knows for sure how deep this will all go. Goldman Sachs anticipates we will see a difficult first half of the year, but the economy will recover in the second half. Check out the article and Graphs in KCM’s article Economic Slowdown What the Experts Are Saying:

In times of uncertainty, one of the best things we can do to ease our fears is to educate ourselves with research, facts, and data.

BUYING Q&A

Is it possible to buy a home right now?

There are several things you can do right now to keep your home search moving forward.

In our area (Northern New Jersey), people are practicing social distancing, or, in some areas, following public health orders to stay at home and self-quarantine. Temporary business closures are also affecting key parts of the real estate transaction, namely appraisals, inspections, closing and title services, and moving. This has created delays and complications. We are constantly looking for ways to adapt and serve safely.

Real estate is an essential business. While our offices are temporarily closed to the public, we are supported with a wide range of technology tools so that we are able to continue to serve you. The slides are provided by www.KeepingCurrentMatters.com & www.Otteau.com (sources mentioned throughout blog)

Buyers (and sellers) should prepare “for a bumpy ride” in the financial markets in the coming weeks and months, but also to be ready for “a tremendous opportunity” in the form of lower mortgage rates and increased home affordability. (Jeffrey Otteau)

Can I tour a house without leaving my home?

We have gotten creative in adopting tools and technology that allow prospective buyers to tour homes virtually.

Where a seller is unable to let anyone into their home due to COVID-19-related health concerns or restrictions, we are finding solution by working with the seller and listing agent.

We have experience working with remote/relocating clients and are used to accommodating requests for a video tour.

Here are ways we can help you get a better sense of a property that interests you:

3D Tours: Some homes have 3D home tours / or Matterport tours. We can send you these and Zillow actually has a “3D Home” label in the upper-left corner of listing photos on listings.

Live video walkthroughs: We can help facilitate a live tour of a home through FaceTime, or similar platforms. This is easier with currently vacant homes.

Pre-recorded video tours: We can plan to do a pre-recorded video tour of the home and then share it with you. Make sure you tell us exactly what you’re looking for in a home so that we know what details to focus on during the tour. We can also capture some of the surrounding neighborhood as well to give you a better sense of the area. Again, this is easier with currently vacant homes.

Our team held its very first Virtual Open House Facebook Live Event on Sunday 4/5 and two days later we had a full priced offer.

Am I missing out if I don’t buy now?

The best time to buy depends on your personal circumstances. Trying to time the market for the best deal is something even professional investors haven’t figured out!

According to economists, the current environment poses both opportunities and challenges.

Opportunities are out there:

Mortgage interest rates are very low, which has the potential to significantly boost your buying power.

At this exact moment, with many people pulling back and staying home, there could be less competition for the still-limited pool of homes for sale.

Sellers may be more flexible on pricing and/or timing in order to close a sale, especially if letting their home stay on the market will cost them or delay their own plans.

If demand stays strong and the crisis passes relatively quickly (both big “ifs” at this moment), we can expect price growth to accelerate like it was before this pandemic started. If that’s the case, it might be a good time for some buyers in some markets to get ahead of any growth in home prices.

Still, the challenges can be daunting:

Inventory is already low and with many would-be sellers holding off on listing their homes right now – that could make it harder to find the right home.

Mortgage interest rates are low, but volatile, and lenders have been slammed with a flood of refinance applications.

It may be difficult to complete the sale on time if connected businesses (appraisals, inspections title services) are closed due to the pandemic.

If the crisis persists and social-distancing and other behaviors last through the bulk of the year, home prices may fall somewhat in response to the lack of demand from buyers. It could make sense for some buyers to adopt a “wait to see” approach.

Should I be Investing?

Some areas are seeing the drop off in competition for real estate investment opportunities as a golden opportunity to lock down a deal. This might be the perfect storm for investors: competition has slowed down, sellers are nervous, interest rates are low and opportunities could be increasing.

If you have the time and willingness to face the current challenges, now could present some interesting opportunities. If you’re risk-averse or don’t feel ready, you’re likely to be more comfortable waiting until the situation is more clear. We are re-evaluating challenges and opportunities for our clients daily, as the situation unfolds. We are also offering complimentary consultations via Zoom – just email Caroline@thegosselingroup.com to set one up.

What can I do now to be ready to buy?

Buying a home right now might be challenging, however there are steps you can take so you are ready to act when the time feels right for you.

Find your price range

A home is more than just a place to live — it is also an investment and a major financial commitment. So, before you buy, make sure that you know exactly how much you can afford. It’s imperative to take a close look at your finances and establish your housing budget before you start looking for homes. In fact, you shouldn’t even apply for pre-approval until you have a solid understanding of home affordability. Otherwise, you may be tempted to borrow as much as the bank will allow, putting a strain on your finances for decades to come.

This guide from lendedu.com will help you ensure you’re making smart choices when it comes to the size of your mortgage loan.

Zillow’s Affordability Calculator can also help you determine what you can realistically afford by plugging in your income, monthly debt and down payment for an estimate.

Keep saving

If possible, continue setting money aside for your down payment. The amount can vary from as much as 20% of the purchase price with conventional loans or as low as 3% if you qualify for an FHA or VA loan. Keep in mind you will need funds to cover closing costs, moving and other expenses.

Check your credit

Your credit score can impact the interest rate you qualify for. You can request a free copy of your credit report from any of the three major credit reporting agencies. Review it carefully and check for discrepancies. Work on improving your score (by paying down credit card debt, for example), and avoid taking out large loans during this time.

Gather info

You can start by reading our recent 6 phases of the buying process blog or watch the short Youtube video. Look at homes online using our website search tool or have us set up a customized search for you to see what’s available in your price range. Think about your must-haves and nice-to-haves so you can focus your search when you’re ready to take the next step. This is also a good time to build your real estate team who can provide helpful neighborhood and market information. Look up and vet attorneys, inspectors, etc…

Identify Needed Documents

A pre-approval letter is usually valid for 60 to 90 days. It is a good time to gather the documents you’ll need to get pre-approved or apply for your mortgage. These include: tax returns, W2s, pay stubs and bank statements. Lenders may also want to see “proof of funds” of your down payment.

SELLING Q&A

Can I still sell my house during COVID-19?

Every case is different and you should schedule a seller consultation with our Team Leader and Head Listing Specialist Caroline Gosselin to discuss your goals and timeline. Our team is in the best position to know the conditions in our area and can advise you on restrictions that might affect selling activities.

In some places, temporary business closures are affecting key parts of the real estate transaction, namely appraisals, inspections, closing and title services and moving. Affected businesses are looking for ways to adapt.

People across the country are practicing social distancing or following public health orders to stay at home. That means showing homes in a traditional way to buyers has changed temporarily. But we have gotten creative in adopting tools and technology that allow prospective buyers to take 3D tours of a home or take a video tour.

Can I show my house virtually?

Virtual or Video tours are an excellent alternative for generating interest in your home if open houses and tours are not an option due to local MLS restrictions or public health orders.

Here are some best practices we are implementing to give prospective buyers a thorough look at your home:

Professional photography, detailed descriptions, floorplans and videos:

Live video walkthroughs: We can help facilitate a live tour of your home through FaceTime, or similar platforms.

Pre-recorded video tours: We can do a pre-recorded video tour of your home and share it with buyers and their realtors.

What can I do now to prepare to sell in a few months, or when coronavirus concerns have lessened?

While it is still possible to sell a home (and we have in the past 2 weeks), it may not be right for your situation. If you prefer to wait, there are steps you can take now so you’re ready to sell when the time feels right for you. (Read our blog on 10 Seller Tips for a Successful Sale.)

Review your timeline

How much flexibility do you have? Can you wait out the coronavirus, or if health risks and public health orders extend into the summer months or beyond, will you need to make adjustments to your timeline? Be realistic and let’s discuss a plan B or C.

Make or plan for renovations or repairs

If there are improvements you can make yourself — interior painting, basic landscaping or other touch-ups — this is a good time to start tackling them. If you need specialists to come into your home to do more extensive work, that may have to wait (though the construction industry has been deemed an essential business). But you can seek out referrals and contact contractors or handy people for verbal estimates and we are happy to recommend any of our trusted vendors.

Stay on top of the market news

We can’t predict how the current economic uncertainty will affect home sales and values in the coming months (or years!), but people will continue to buy and sell homes. We can set you up for a customized neighborhood update daily, weekly or monthly – so that you can look at comparable home sales in your area to get a sense of how your local market is faring in real time.

Is spring still the best time to list a home for sale?

Every year, research analyzes millions of U.S. home sales to pinpoint a time window in which homes sell faster and for more money compared with other times of year.

This year, an analysis was released by Zillow in February (before news of the coronavirus). It found that U.S. homes listed for sale in April sold faster and homes listed in early May sold for more. Whether that will hold true this year is unknown.

The analysis includes job market and mortgage rate data; both of those areas are likely to be significantly different this year than in previous years. It’s also worth noting that homes sell throughout the year at different price points in various regions and our local markets have variations to this.

How can I improve my home’s curb appeal so I’ll be ready to sell? (Great question!)

There are many tasks you can tackle yourself in preparation to sell. You may need to do a few touch-ups closer to listing, but you can get some of the big jobs out of the way now.

Spruce up your yard: Trim bushes, take note of any trees that may require professional care, add grass seed to patchy areas in your lawn and weed garden beds and mulch.

Clean your driveway and exterior: Spray off your driveway using the strongest setting on your hose or a power washer if you have one. Powerwash the exterior and walkways (Don’t power wash the roof -it can damage your shingles!). Clean your windows.

Touch up trim and doors: Unless your paint is in bad shape overall, focus on areas that stand out. A fresh coat of paint around windows and door frames can refresh your exterior, and a newly painted door in a contrasting color can create an inviting entrance. We have great painter recommendations.

Update fixtures & put in bright bulbs: Check your porch and driveway lighting. If the fixtures are rusty or dated, replacing them is a quick and inexpensive improvement.

Depersonalize: Just as you would declutter the interior of your home and remove some of the more personal items, do the same with your yard. You may love your garden gnomes or pink flamingos, but they could be a distraction for buyers. And, if your yard is filled with outdoor toys or a trampoline, you’ll want to pack those up before taking exterior photos or listing your home.

Get a Staging quote – this can be done virtually. We highly recommend Interiors by Laura Credico – you can download her free homestaging guide. She is also offering free 30 mins virtual staging zoom calls. Cindy Gelormini can also help give you painting recommendations and staging.

FINANCES & DISASTER RELIEF PACKAGE Q&A

Why are mortgage rates fluctuating?

Mortgage rates were at record lows recently, but they shot up when a large number of homeowners rushed to refinance their mortgages to take advantage of the low rates.

It may be that lenders increased their rates in an effort to slow down the refinancing requests so they could better manage the demand. If that demand does drop, the rates are likely to drop too, according to economists.

That said, the stock market, where mortgage-backed securities are traded, has been unpredictable. That could create further uncertainty around rates as investors look for places to put their money.

We highly recommend speaking to our trusted lender Mark Yecies of Sunquest Funding, who is a wealth of information, to understand how the market impacts mortgages and your situation in particular.

Is now a good time to refinance?

Rates are low right now and have been lower than historic norms for some time. Whether it makes sense for you to refinance depends on the interest rate on your current mortgage and the interest rate on the one you expect to get.

We recommend you speak to a mortgage specialist, such as Mark Yecies of Sunquest Funding. Here is one of his market updates.

I’ve lost my job. Where do I go for temporary housing assistance?

There’s an overwhelming amount of news and activity around this question nationally. Forbes has managed to wrangle most of it into a well-organized blog that is updated as new initiatives at the federal, state and local level take effect.

Here are some highlights:

On March 18, 2020, the federal government issued a 60-day moratorium on foreclosures and evictions for homeowners who cannot pay their federally backed mortgages.

The government also extended protections to homeowners whose mortgages are backed by two government-sponsored enterprises: Fannie Mae and Freddie Mac. Those homeowners are allowed to reduce or defer their payments for as long as a year if they lose income or employment due to the coronavirus. Some private lenders have followed suit.

Administration officials said the moratorium should help financially strapped renters by giving landlords breathing room to pay their mortgage if their tenants can’t pay their rent.

The picture is a more complicated one for renters. The federal Department of Housing and Urban Development encouraged public housing authorities to stave off tenant evictions.

Mortgage forbearance information: If you have lost your job or are experiencing economic hardship, you may be eligible for forbearance or other mortgage relief. The Consumer Financial Protection Bureau helps explain forbearance in detail. Here is a list of banks offering some relief.

How can I protect my credit score?

Credit scores affect your ability to rent or buy a home, so it’s important to protect yours, especially if you’re struggling financially.

The Federal Consumer Financial Protection Bureau recently issued advice on protecting credit scores during the current health crisis when you might respond to lost income by charging more on your credit cards.

If you’re unfamiliar with credit scores and the roles they play, this resource from the financial protection bureau is a good place to start.

What are the details of the Disaster Relief financial package passed by Congress? How does it impact me and/or my business?

National, State and local governments have announced new initiatives to support businesses and workers facing economic hardship due to the outbreak of the novel coronavirus COVID-19.

The New Jersey Economic Development Authority (NJEDA).

Watch this video, (zoom webinar) hosted by The Gosselin Group, where David Tepp of Tepp Financial and Ellen McHenry of the UCEDC discuss the new CARES ACT.

ADJUSTING TO OUR NEW NORMAL AT HOME

Take on some “home projects” to refresh your space

Check out Erica Sooter’s blog Dwell Beautiful, an interior design and DIY/craft blog specializing in advice and tutorials for those on a budget.

Check out The Paint Diva’s blog for some paint color ideas.

Learn how to keep toys organized with The Toy Tamer: It doesn’t matter how organized you are — a surplus of toys will always ensure your house is a mess waiting to happen.

Keep local businesses in mind!

Merchants are working hard to continue to service their customers in these uncertain times.

Below is a list of most of the merchants (food/drink, retail/services and classes/lessons/health and wellness) and a description of how they are currently operating or if they are closed until further notice.

Please support them however you can until we’re on the other side of this pandemic.

Stay Connected with Your Network

Spend time each day reaching out to friends, family and colleagues… talk to them, extend your gratitude for them, ask how they’re doing and simply show them you are present in their life during this hard time.

Learn New Things

Listen to podcasts, audiobooks, documentaries, sign up for online courses and webinars! All those things you’ve always wished you had time to do!

Work on Yourself

Everyone has different ways of dealing all the uncertainty and challenges we are facing. Listen to podcasts, audiobooks, documentaries, sign up for online courses and webinars! All those things you’ve always wished you had time to do! Grow your awareness, emotional intelligence and/or cultivate your spiritual side.

The health of our clients, sales team, staff, their families and our communities is our top priority.

While our offices are temporarily closed to the public, we have always invested in a wide range of technology options so that we are able to continue to serve you.

Our location has changed.

Our commitment to you has not.

Our hearts and thoughts go out to the people who have been affected by this unprecedented event. And we also want to express our appreciation to the healthcare workers, local communities, and governments who are on the front line working to contain coronavirus.

Curious about current home prices in your town? Want to know more about the outlook for the New Jersey market in 2020 and beyond?

Call Caroline at 973-985-6117 or email at Caroline@thegosselingroup.com