Want to know what is happening in your community?

WE MAKE IT EASY!

Try a subscription today, and you’ll get full access to The Village Green and experience the best local news coverage around.

If you are a current subscriber Please login to continue reading.

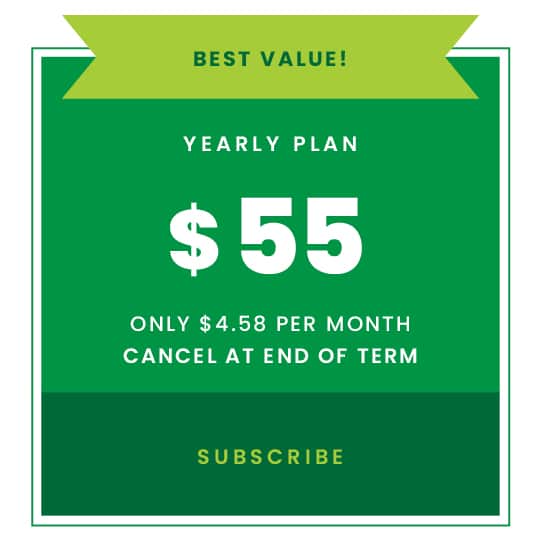

Choose Your Plan: