From Mark Slade:

Hi, this is Mark Slade from The Mark Slade Homes team of Keller Williams Midtown Direct and here is your South Orange annual real estate recap for 2025.

I love analyzing the market and tracking the performance of the market as I do it for my own knowledge and for the benefit of my clients. I also post stats on Instagram and Facebook to reach more people. And to further qualify, these stats are derived from the Garden State MLS listings dated January 1, 2025 to December 31st, 2025. They must also close within the same calendar year, so my stats might differ a little bit from other people because, very often, we have properties at the tail end of the preceding year that do close in the current year. This is done to track the market closer to the vest, so I analyze the stats when it comes to where we stand with listings in a given 365-day year calendar.

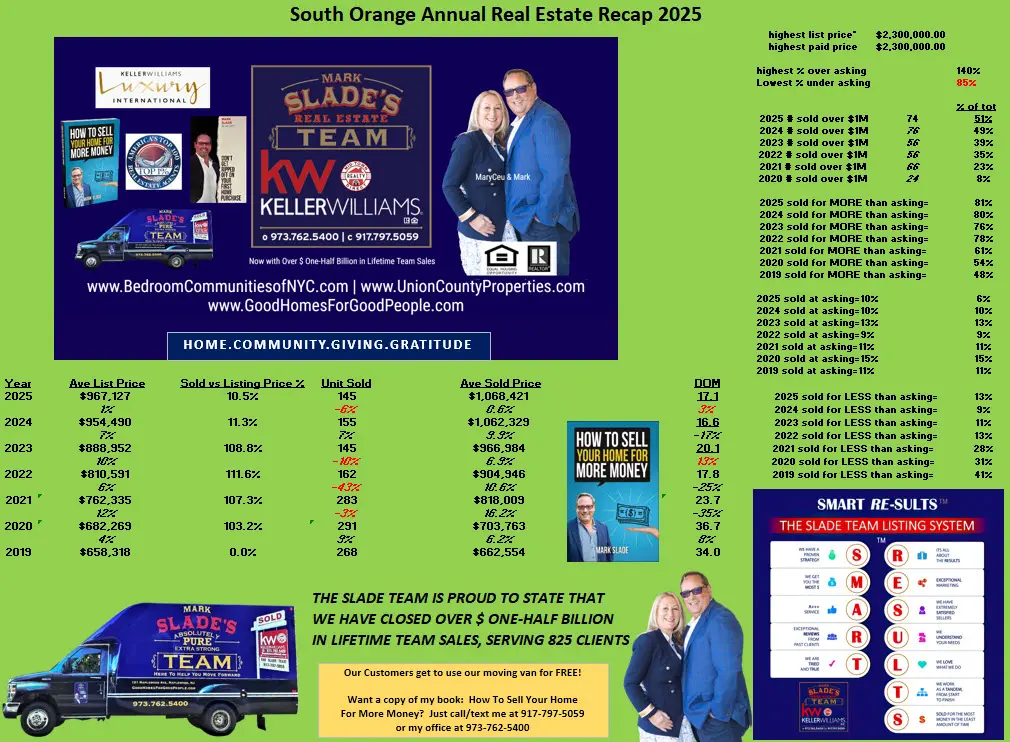

Let’s get right to the meat and potatoes of it. First off, we had a pretty solid year in terms of price. We saw the average sale price in South Orange rose to $ 1,068,421, representing a 6% increase over the preceding year. At the same time the average list price actually rose a little bit more, from $954k to $967k, which was a full 1% increase over the preceding year.

As a result of the average list price going up a little bit higher relative to the sale price, we saw a slight decline of eight-tenths of a point to a 10.5% sold versus list price percentage performance. Further, units sold declined by 10, so only 145 homes sold in South Orange, versus 155 in the preceding year. In comparison, sister town Maplewood went up by two units. Interestingly, South Orange’s unit sales retreated to the same number we had in 2023. This represents a 6% drop in units sold. It’s not a tremendous difference, but it’s still something to note, and mostly due to a severe lack of inventory.

Now, for Days-On-Market, aka DOM, that’s a measure that is from the date the property is listed to the date the property is put Under Contract (UC)/Sale Pending. This statistic increased slightly from 16.6 days to 17.1 days. And I view that as a 3% decline in terms of performance, while still being reflective of a very healthy market for sellers.

I like to see where we stand in terms of the highest list price and the highest price paid. And they happen to be one of the same, ringing in at $2.3 million, and that was for 303 Montrose. One of the more exciting results I measure is “the highest percent over asking,” which registered at 140% this year in 2025. Last year our highest percentage was a touch higher at 145%.

Conversely, the lowest percent to list price – meaning the lowest price paid as a percent of asking – was 85%. his also came in a bit worse than the preceding year, which was a little bit interesting to me.

Additionally, I like to look at the number of properties that sold for over a million dollars, and we ended up selling 74 such properties for over $1 million. These $ Million plus sales represented 51% of the total inventory, kind of a crazy number.

Lastly, I like to track the market to see how many properties sold for “over asking,” “at asking” and “under asking.” I view this as the biggest indicator of how strong a market is, whether for a Seller or a Buyer. In the case of properties being sold for more than asking, we saw this stat increased to 81% of the total units sold in 2025. At the same time, the units that sold “at asking,” surprisingly went down by 4%, from 10% in 2024 to 6% in 2025. And, the number of units that “sold for less than asking” increased to 13%. I view this last statistic as a little bit of a surprise to me to see such an increase over the preceding year.

All in all, it was a very healthy year for real estate in South Orange, New Jersey. If you have any questions, I’m happy to answer them with any ability I have and I’d love to hear from you. You can reach me at 917-797-5059. Have a great day. Thank you so much.

Should you prefer to listen, here is the blogpost: