From The Allison Ziefert Real Estate Group:

When you purchase a home or property, title insurance protects the purchaser and their lender from financial loss sustained from defects in a title to a property. It ensures that the buyer has clear ownership of the property and that there are no hidden liens, encumbrances, or other issues that could affect the title’s validity.

Standard Owner’s Title Insurance typically covers “the past”:

- Forgery and fraud

- Undisclosed heirs

- Errors in public records

- Incorrect legal descriptions

- Prior liens or encumbrances not of record

- Encroachments, overlaps or boundary disputes

Title insurance rates are set by the state.

Enhanced Owner’s Title Insurance offers additional protections for “the future,” including:

- Post-policy forgery and fraud that impact your title after closing

- Building permit violations from previous owners

- Covenants, conditions, and restrictions violations

- Post-policy encroachments (such as a neighbor building a fence on your property)

- Zoning law violations

- Certain living trust coverage

- Inflation coverage (automatic increase in coverage amount over time)

These policies cannot be purchased retroactively and they cost about 20% more than the standard policy.

Local real estate attorneys who we have conferred with differ in their opinions on these policies. Some say that they are not worth the extra expense and others recommend them for every client.

In summary, while a standard owner’s title insurance policy offers essential protection, an enhanced policy can provide additional safeguards that might be valuable depending on your specific circumstances and risk tolerance. It’s often a good idea to discuss the options with your real estate attorney or title insurance agent to understand the best choice for your situation.

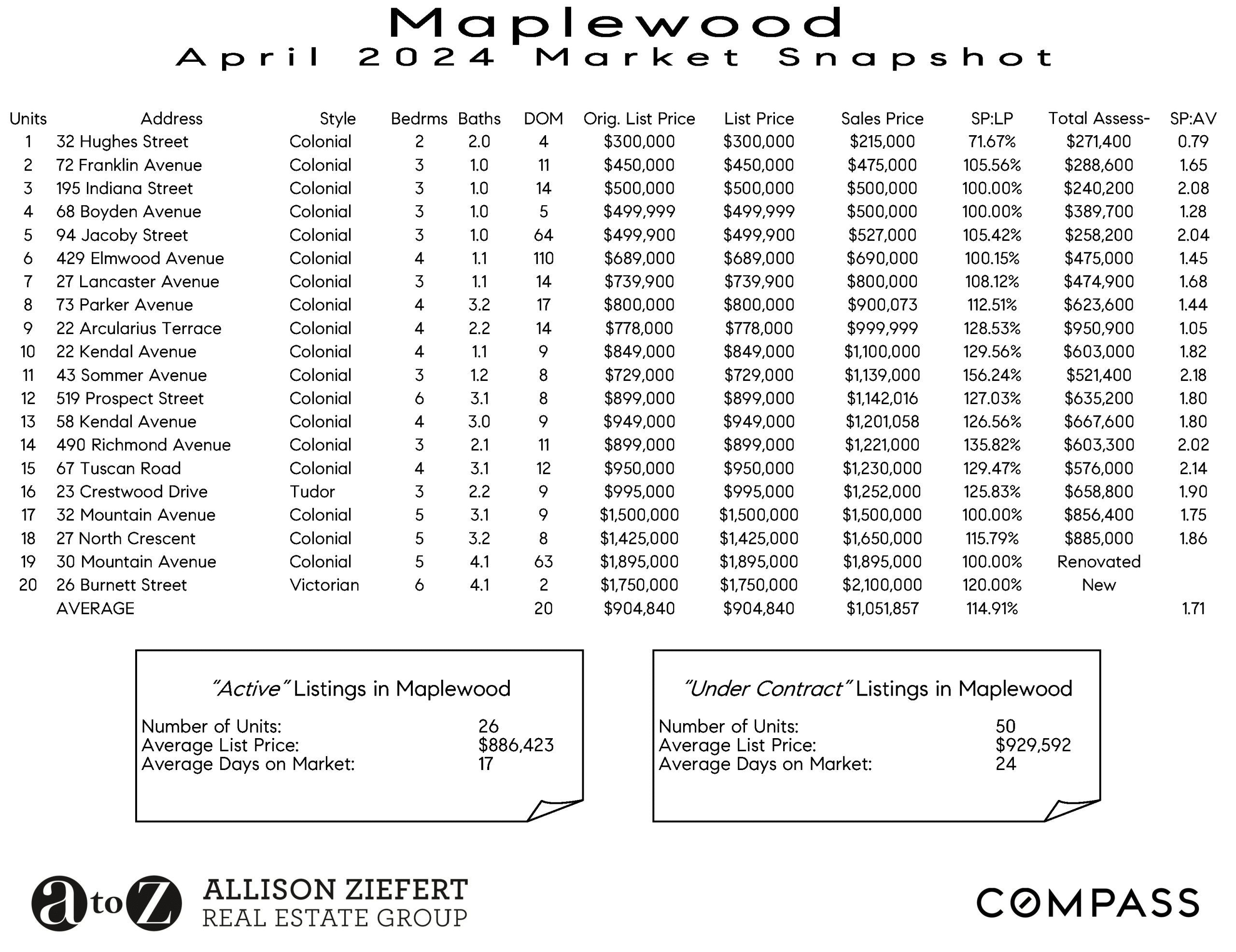

The local market has seen prices rise significantly from 2023. YTD Maplewood prices are up 14.87% with homes selling at an average price of $928,930. The number of units sold is up by 29% YTD over last year. The average home in Maplewood sold for 111.72% over list price, an increase of 6.2% YTD over last year.

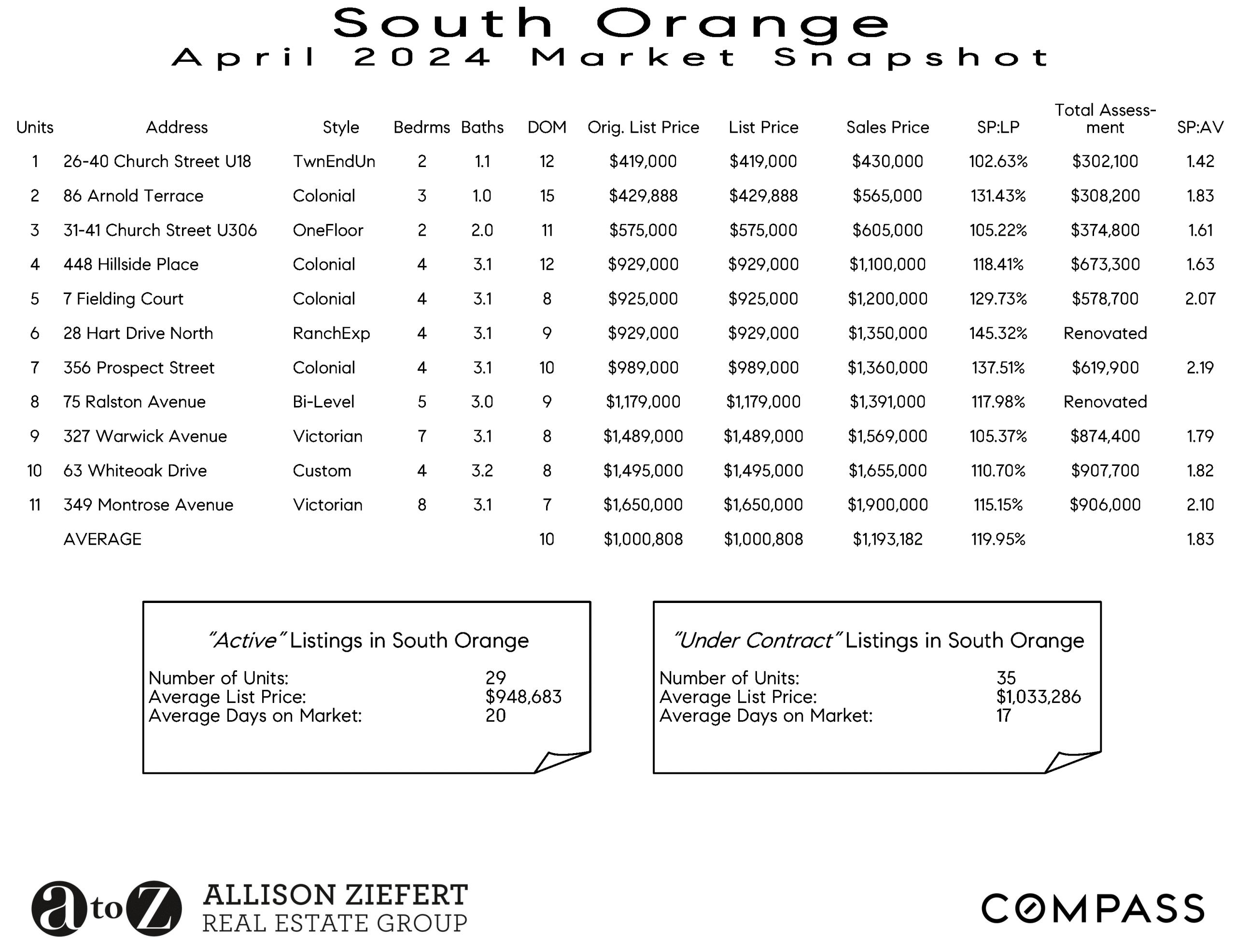

In South Orange the average sale price of a home is up by 19.98% YTD over last year with homes selling at an average price of $1,028,061. Yes, that’s over $1 million! The number of units sold was down by about 10.8% YTD. The average home in south Orange sold for 111.31% over list price, an increase of 6.39% YTD over last year.

Here is our latest market report for South Orange:

Here is our latest market report for Maplewood:

Real estate moves at its own pace. We are here to help you move at yours. Just email us at [email protected] if you would like to discuss your plans and goals with us.

The Allison Ziefert Real Estate Group is a top producing real estate team based at Compass in Short Hills, New Jersey. We are local market experts, specializing in real estate and homes in Maplewood, South Orange, Millburn/Short Hills, Montclair/Glen Ridge, West Orange, Morristown and the surrounding New Jersey towns. We’ve also got you covered coast to coast with the best connections to top agents around the country in any market you are exploring. We are driven by earning great testimonials and referral business from happy clients.