From The Allison Ziefert Real Estate Group

If you’re interested in the current real estate market in South Orange, Maplewood or around the country as either an aspiring buyer or potential seller, you might have seen the word “bubble” being bounced around during your research.

Well, know first that this is not like 2008. The Great Recession was triggered by unscrupulous lenders, overly-complex Wall Street investment shenanigans and a decades-long indifference toward regulation.

But, today’s market conditions are partly a result of what happened all those years ago. Namely, builders stopped building.

Not literally, of course, but the construction industry sure did slow down the pace of newly built homes coming to the market. This was not necessarily entirely the fault of builders, as their collective hesitancy stemmed from the incredible impact of the 2008 fallout. It makes sense, but requires some perspective. Here’s an article from 2016—yes, 2016—that discusses why building slowed so much, and that it took almost ten years, at the time, to get back on track. It never returned to its previous pace, however. Here’s a more recent take from 2019 that cites the market’s serious housing deficit, one year before the pandemic.

Fast forward to 2022, two years into a hopefully declining global pandemic, and everyone who’s anyone seems to want a home. Unemployment is very low, just above three percent, so plenty of people have measurable, mortgage-ready incomes.

The pandemic cast a searing, sun-hot light on the decade-plus glut in new construction. A few months into it, people wanted to find new places to live, to discover untapped mid-sized markets and hip, up-and-coming communities as part of an unpredictable relocation rush.

Apparently, people have been saving their pennies since 2008 because a surprising number of homebuyers are hip-deep in liquid assets, able to bid tens of thousands and often much more above list price. Spurred on by incredibly low mortgage interest rates, the race to own a house found people neglecting inspections, foregoing financing and sometimes buying sight unseen, offer trends that have thankfully cooled of late.

To salve the market, the Fed recently tweaked interest rates a couple of times. As of this writing, the 30-year fixed rate is at 5.48 percent.

Normally, as market activity slows, prices come down. But that’s not really happening. A recent Zillow survey showed that many experts believe that it will take until 2024 for us to see the market return to 2019 levels.

The problem is that inventory shortages are overpowering the impact of higher mortgage rates. Demand is severely outpacing supply. (Remember, we had more than ten years of decreasing housing stock.)

Plus, mortgage rates aren’t really that high. Historically speaking, under six percent is still very attractive. They are high enough to spook some first-time buyers, especially those already pushed aside or worried by the over-list-price pace of the market. The lack of power behind the punch-up in rates has surprised a lot of people.

All said, buyers who can brush off that pain are more experienced, and ready to compete.

And speaking of being ready to compete, the largest generation of Americans ever is now entering its prime earning years. We agents have been wondering for years when Millennials would start to impact the market. Well, here they are.

There’s another, even more prepared group not deterred by a couple points in interest rates having an impact on the market: institutional investors. Cash-rich corporations are creating a new real estate asset in single family rentals.

Called “own-to-rent,” these investor entities are buying large swaths of homes to turn them into long-term rental communities. Some are even partnering with builders to create them from the ground up. In North Carolina, these groups are the largest type of rental home owner. Around the country, Homeowners’ Associations are hoping to slow them down, according to lawyers.com.

Point is, they’re absorbing homes at the median price level, and doing so in big numbers. No private stand-alone buyer can compete with that.

Maybe Washington’s fight against inflation, which will likely include another interest rate bump, will result in a slower market and then, lower home prices. But, with this kind of perpetual supply-demand imbalance, expect high prices to stick around.

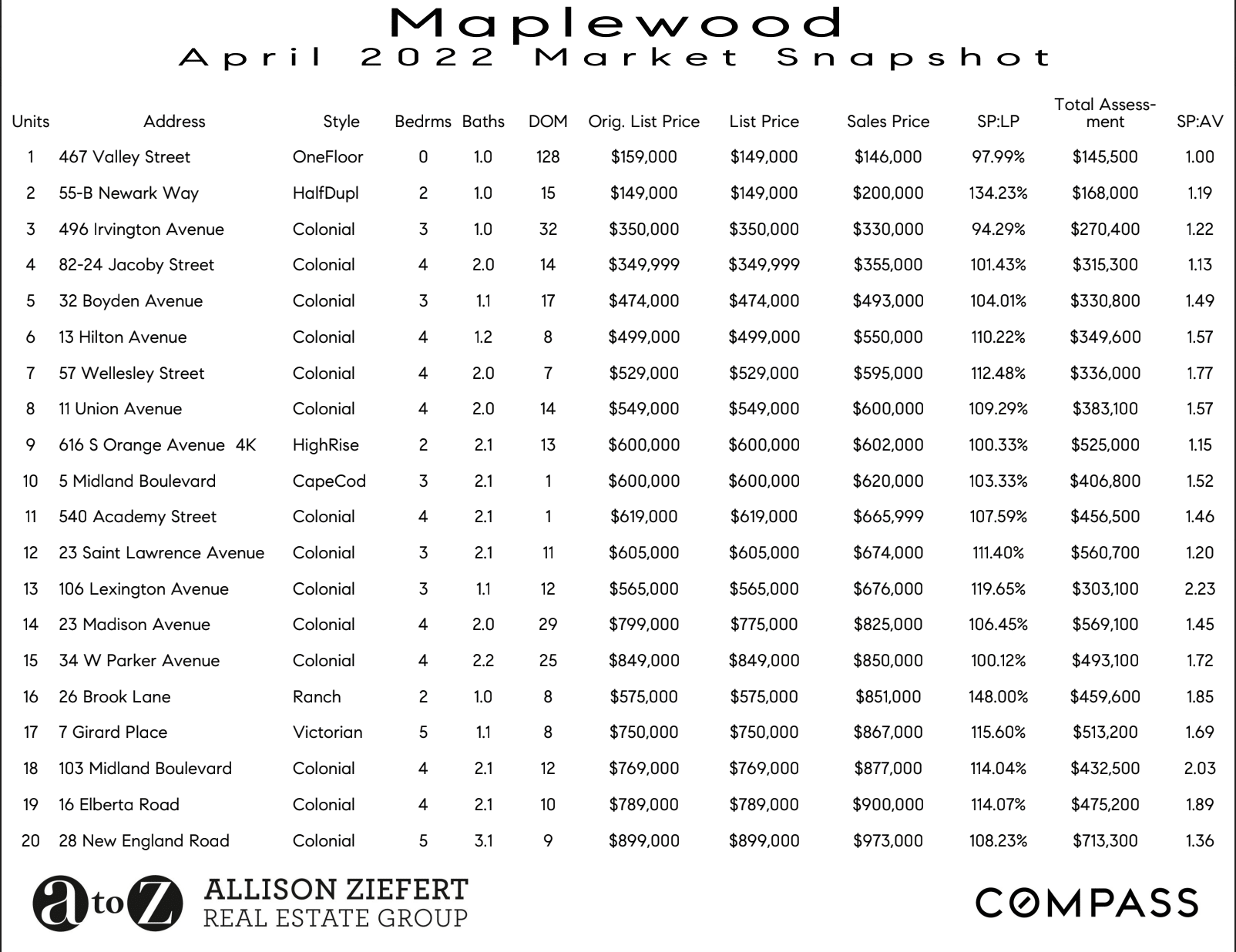

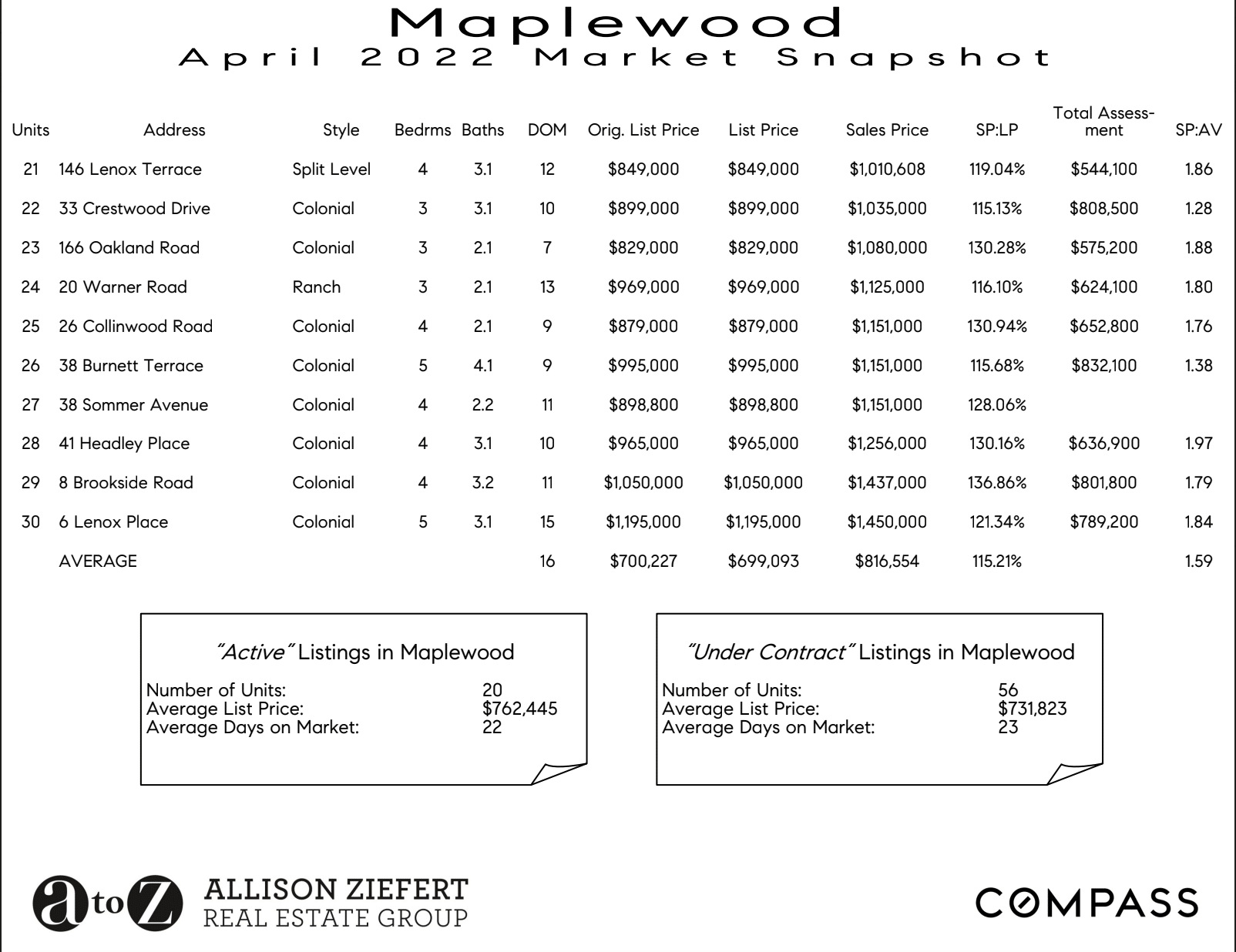

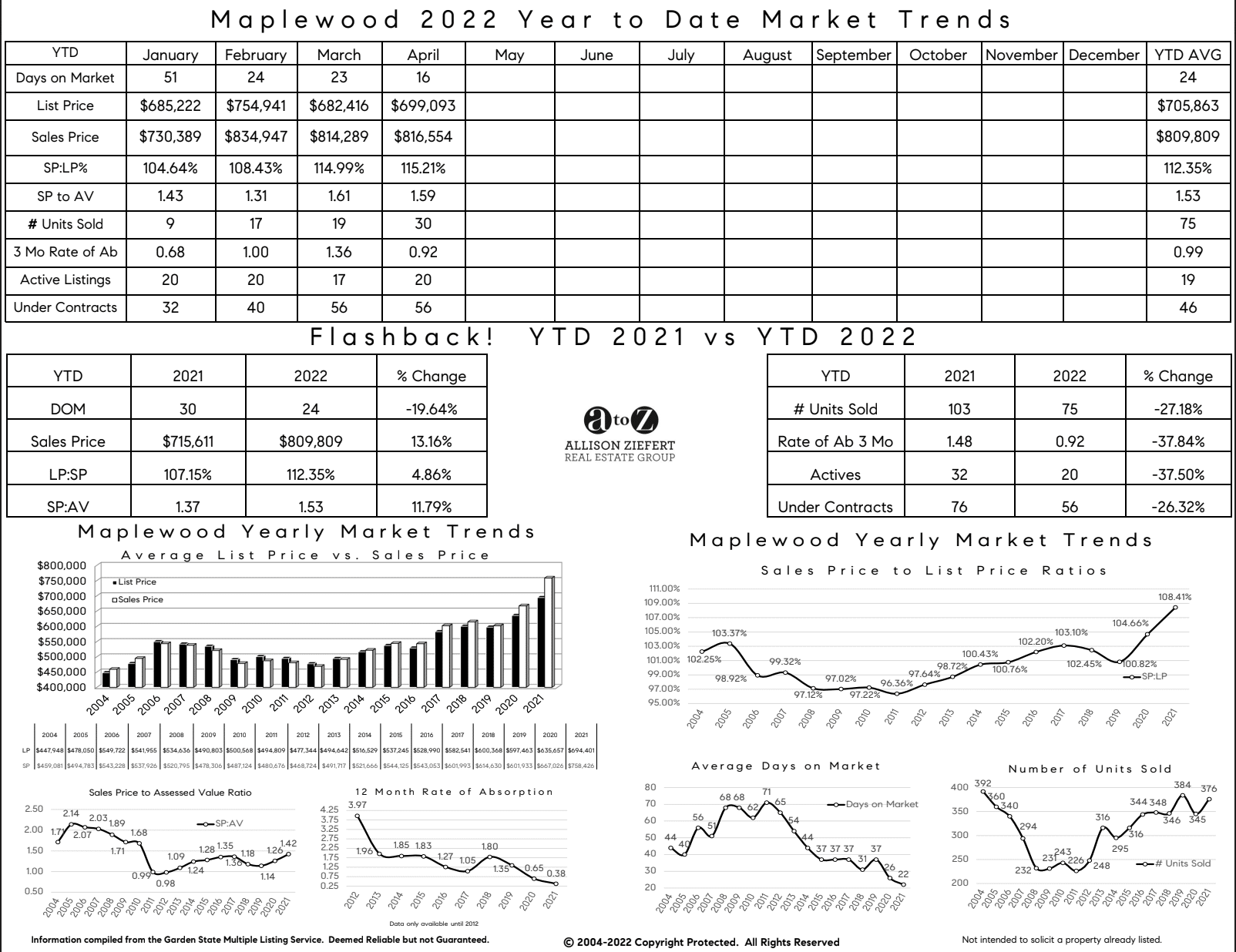

Here is our Maplewood Market Report for April 2022:

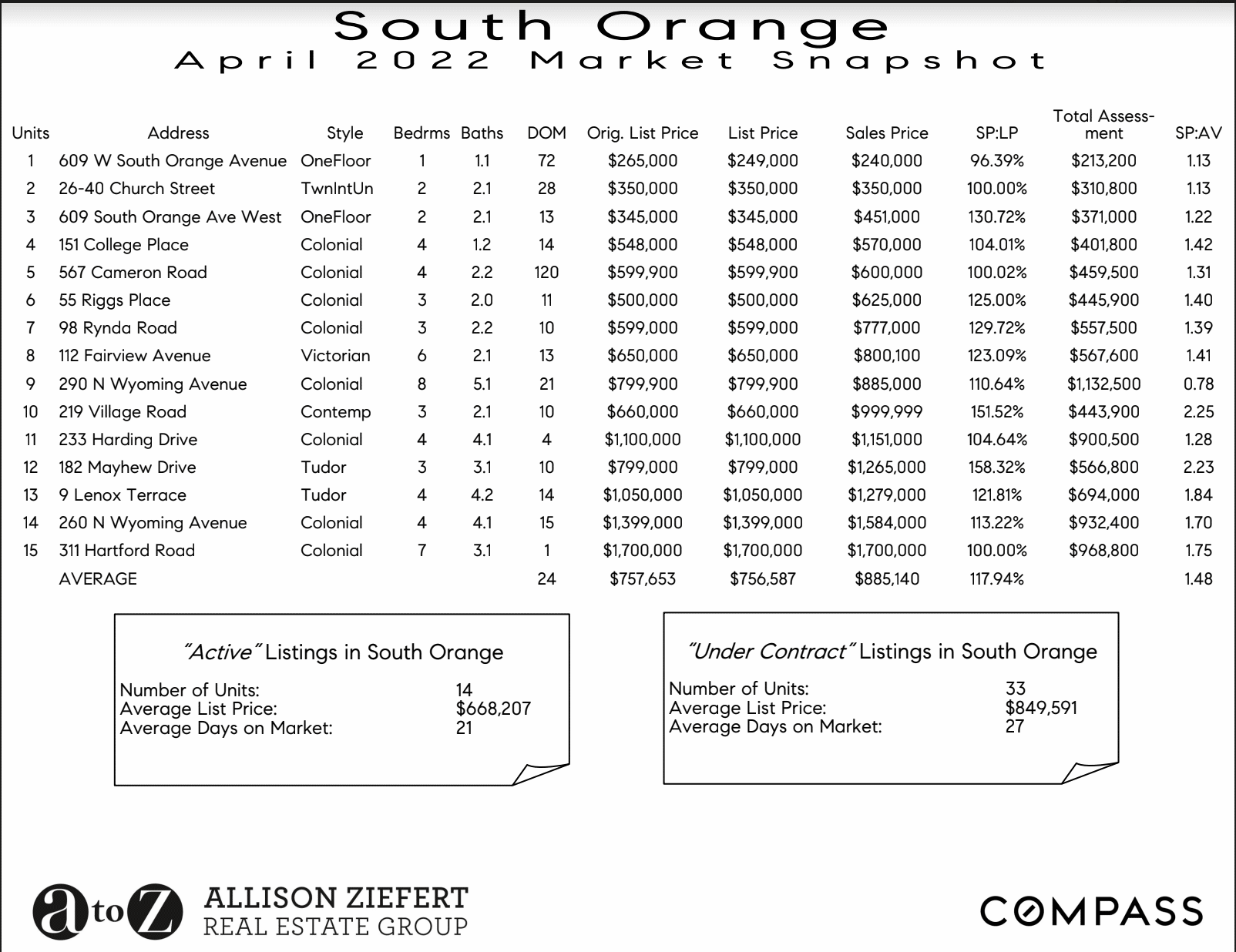

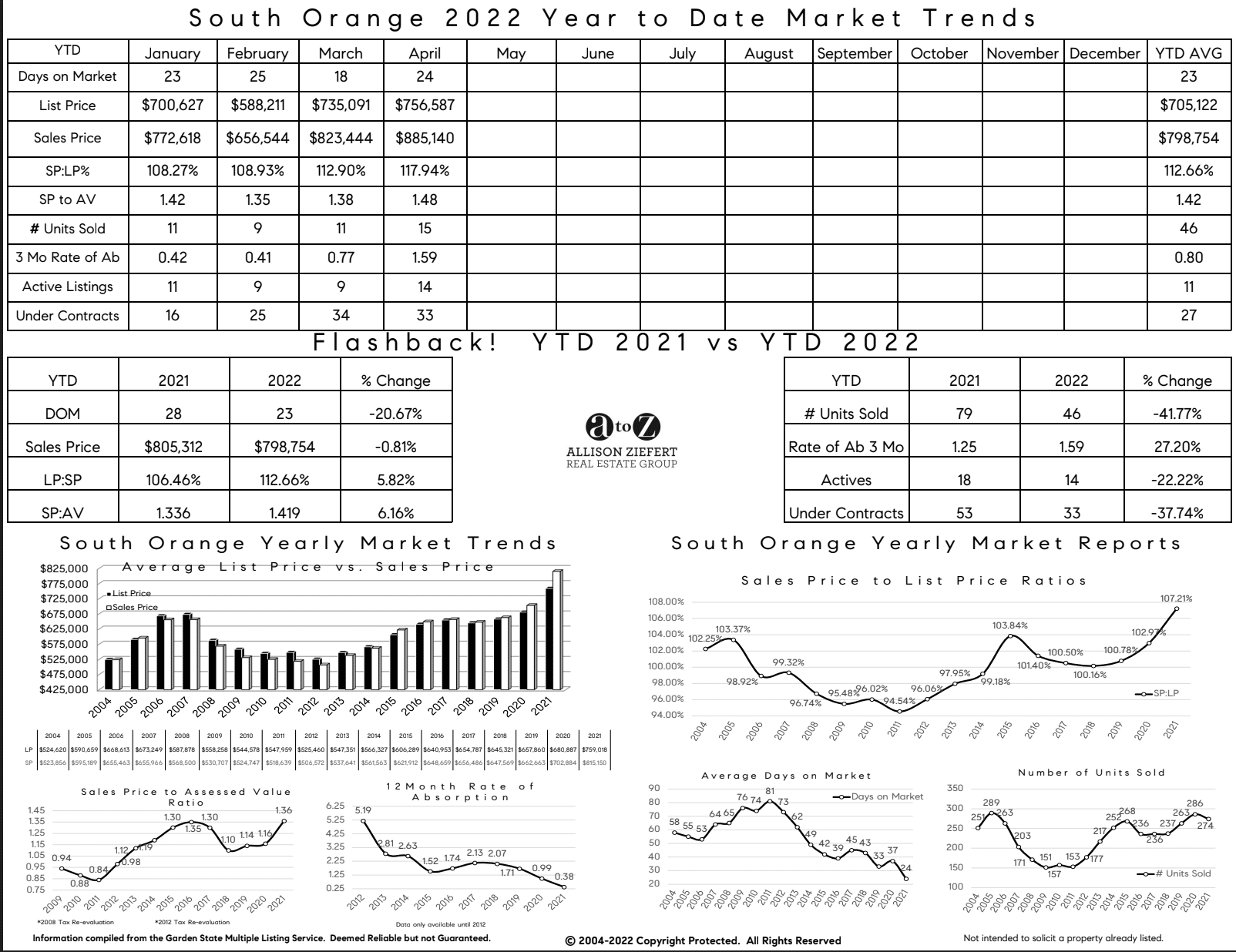

Here is our South Orange Market Report for April 2022:

We’d be happy to consult with you confidentially. You can email Allison at allison@azhomesnj.com to arrange a time to talk.

The Allison Ziefert Real Estate Group is a top producing real estate team based at Compass in Short Hills, NJ. We are local market experts, specializing in real estate and homes in Maplewood, South Orange, Millburn/Short Hills, Montclair, West Orange, NJ and the surrounding towns. We are driven by earning great testimonials and referral business from happy clients. You can read our testimonials here.