From The Allison Ziefert Real Estate Group:

If you’re planning to sell a home in South Orange or Maplewood, NJ there’s a critical new law you need to know about. New Jersey has officially passed a significant expansion of the so-called “Mansion Tax”—and it could cost home sellers tens of thousands of dollars in new taxes starting next year. The aim is to add $250-280 million to the state’s coffers as part of its 2026 budget.

This change isn’t just aimed at luxury estates. With local home prices well above $1 million in many of our communities, it will impact a growing number of everyday homeowners.

A Quick Recap: What Is the NJ Mansion Tax?

New Jersey has had a “Mansion Tax” since 2004 when a million dollar home really was a mansion. Originally the tax entailed 1% tax on homes sold for $1 million or more, paid by the buyer.

But times have changed. In today’s market a million dollar home is not a “mansion.” The average sale price today in both Maplewood and S. Orange is over $1 million. This new law will affect a broad swath of homeowners across suburban Morris, Essex and Union Counties. The fee will now be paid by sellers not buyers.

What the New Mansion Tax Law Says

Effective July 10, 2025, the structure of the Mansion Tax in New Jersey is changing. Here’s what you need to know:

- $1 million+: The existing 1% tax remains, but it shifts from buyer to seller

- $2 million+: Seller pays 2%

- $2.5 million+: Seller pays 2.5%

- $3 million+: Seller pays 3%

- $3.5 million and above: Seller pays 3.5%

These tiered taxes are in addition to the standard NJ realty transfer tax (about 1%) also paid by sellers with some exceptions for seniors and people with disabilities.

🗓 Key Timeline:

If you sign a contract before July 10, 2025, and close by November 15, 2025, you may be eligible for a refund of any amount paid above the 1% level.

What This Means for Sellers in SOMA

This isn’t just a policy shift—it’s a serious financial hit for many home sellers and the change will impact vacant land and some commercial properties as well. Here’s how it could affect you:

1. 💰 Reduced Net Proceeds

The fee has now shifted from the buyer to the seller, netting sellers less for their homes. Selling a $3 million home after the law takes effect? That’s $90,000 in new taxes that you would not have had to pay prior to the new law.

2. 🏡 Fewer Listings, Tighter Inventory

Sellers may be disinclined to list their homes to avoid the tax, compounding the already low inventory.

3. 📉 Unexpected Impacts in a Buyer’s Market

If the market shifts and home prices level off or drop, sellers may be forced to lower their asking price—while still paying higher taxes at closing and this could put them under water. Conversely, buyers may pay more for homes since the burden of the tax is now on the seller.

4. 🛑 Buyers and Investors May Look Elsewhere

Out-of-state buyers could view NJ as less attractive due to higher closing costs and seek alternatives in New York, Connecticut, or Pennsylvania.

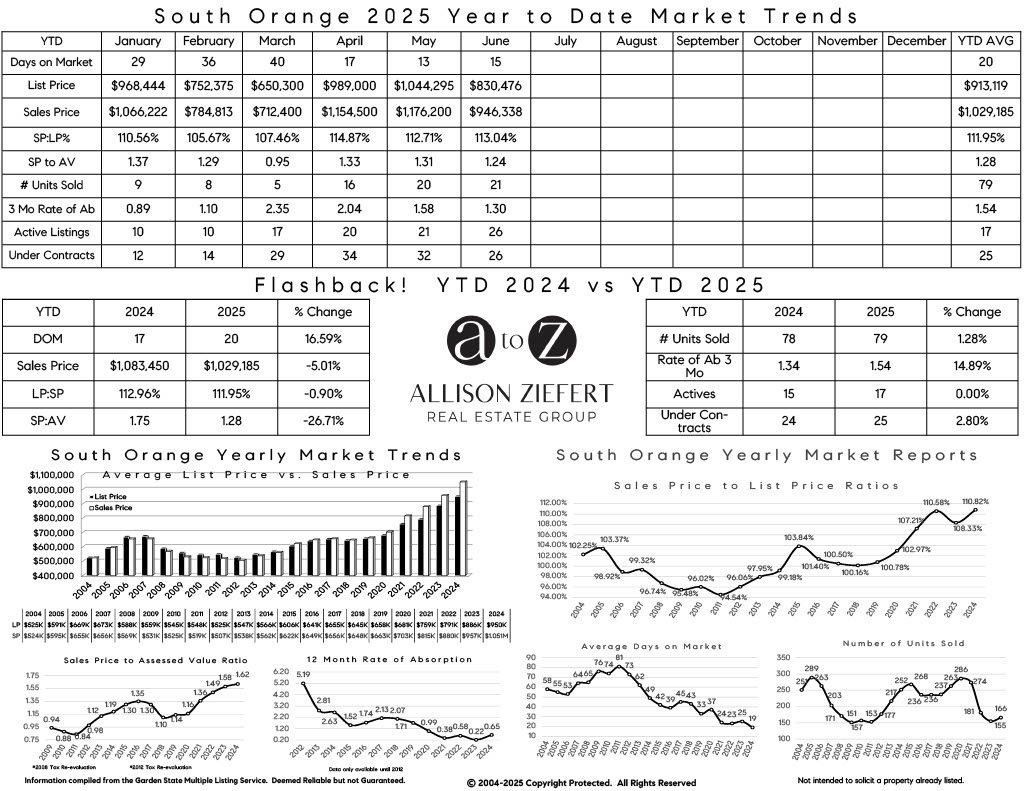

SOMA Market Reports

Here is our latest market report for South Orange:

Here is our latest market report for Maplewood:

📞 Let’s Talk Strategy

We will be watching to see how this change plays out in the market in real time. Whether you’re thinking about selling now or want to understand how this law might affect you in the future, we’re here to help. If you’d like to consult with us please email us at [email protected] or visit njfromatoz.com to learn more about how we help sellers like you succeed in every market.