The Maplewood real estate market was the strongest in six years by the end of 2014. It’s the story of a huge comeback — and who doesn’t like a good story about a comeback?

In 2008, prices dropped precipitously as inventory started to expand. Maplewood was hit especially hard by the recession because a large percentage of its inventory is ideal for first-time home buyers who want to leave the city. These young urban professionals were also the same generation facing enormous college debt, high unemployment rates, lower entry level salaries and major job insecurity (if they had one).

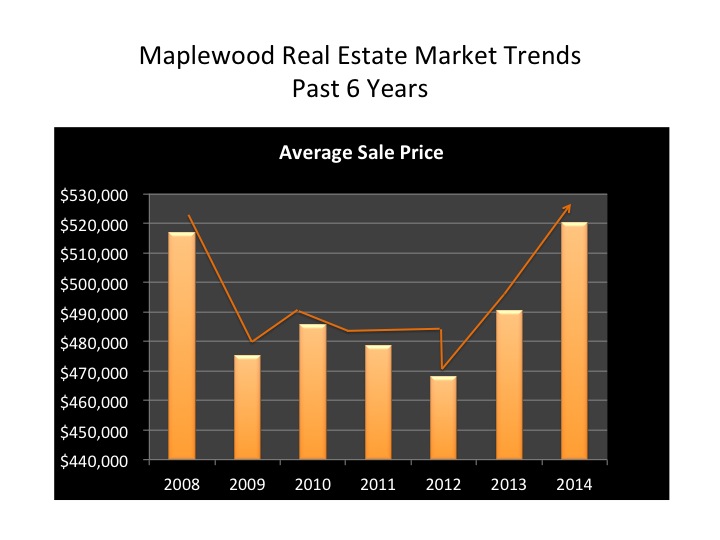

Real estate is a trickle up market. If the first-time buyers aren’t out, then those who want to sell and move up to a larger home also have to stay put and so on. In 2011, Congress passed a short-term stimulus bill for the real estate market titled “The First Time Home Buyers Tax Credit” which provided an increase in sales, but it went right back down after its expiration.

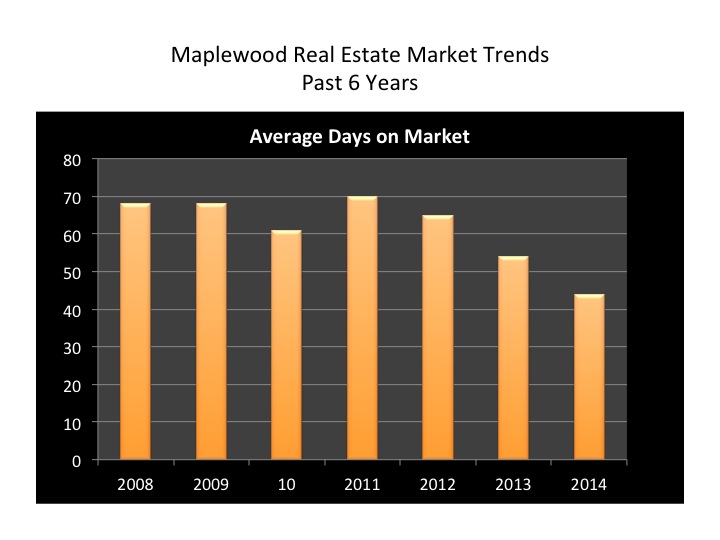

However, as the economy slowly recovered, unemployment decreased, and jobs became more secure, the first-time home buyer came back into the market and fueled the recovery organically in Maplewood. This is especially true in the last two years when the average sale price of a home exceeded its highest value in 2008 — making it the strongest market in six years.

No one can unequivocally predict the future of a market like real estate since it has so many variables. Because it is a commodities market it is influenced by psychological factors as much as anything else. If buyers think prices are going up they will rush to get in now. And that’s my prediction for the spring 2015 market. Because the interest rates are still incredibly low, unemployment is the lowest it has been in years, and the amount of inventory in Maplewood is incredibly low, price should continue on an upward trajectory.

Data and analysis provided by Amy Harris of Amy Harris Real Estate | Keller Williams Premier Properties. For more information on South Orange / Maplewood real estate trends visit Amy’s blog here: https://www.amyharrisonline.com/blog or email her at [email protected].