From The Allison Ziefert Real Estate Group:

With revaluations getting underway this year in both South Orange and Maplewood, many homeowners have concerns about the impact on their finances. Will their already high property taxes go up even more?

We know from recent history that revaluations can be contentious, especially when property owners feel that their properties have been unfairly evaluated. As a real estate professional, I know that markets do not like uncertainty and, for a short period of time, there will be some uncertainty in the eyes of buyers surrounding the final valuation on SOMA properties which will not be known until 2024. As realtors, we will have a lot of questions to answer from both potential buyers and homeowners about what this means for them.

That said, there is no doubt that revaluations are necessary in both communities. Communities are mandated to conduct them periodically and often choose to undertake a revaluation when property values are significantly over or under their market values. The goal of a revaluation is to fairly assess the value of each ratable based on its current market value. Right now assessed values and market values in SOMA are completely out of whack.

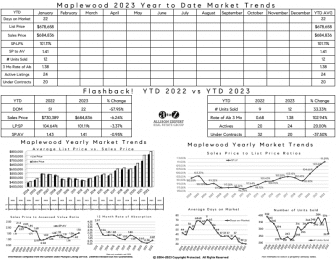

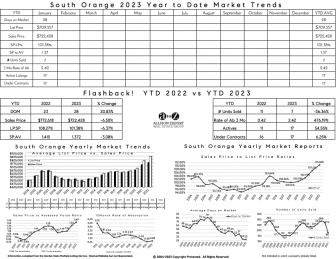

For example, in 2022 Maplewood homes sold for an average of 56% more than their assessed value and South Orange homes sold for an average of 49% more than their assessed value. That means that there is a lot of correcting to do to bring assessed values in line with market values.

My advice is not to be fearful. The goal here is a fair outcome for all taxpayers.

Some things to keep in mind:

- A revaluation should be revenue neutral. It is not intended to raise the total amount of taxes collected but to distribute the tax burden equitably.

- If the assessed value of all properties is brought to current market value the tax rate will go down.

- Not all property owners will have their tax bills increase – some will stay the same and some will be reduced.

When buying or selling a home in SOMA there are some taxes you may not be expecting that you should be aware of as they may impact your net profits from your sale. Here is an overview:

NJ Realty Transfer Fee

The State of New Jersey imposes a Realty Transfer Fee on the seller of real estate for recording a deed for the sale. The RTF is calculated based on the amount of consideration noted in the deed. The RTF applies to every conveyance of title to real property in New Jersey, unless the deed or transfer meets an exemption. Exemptions would include things like transfers between a parent and child or spouses, or where the consideration is under $100. Rates for the RTF vary depending on the amount of the sale price, age and income level of the seller. Generally, a good ballpark is that the RTF paid will be about 1% of the sale price. Here is a handy calculator you can use to determine the amount of your RTF.

“Millionaire’s Tax”

As a supplemental fee to the RTF, the State imposes a fee on the recording of the deed for the sale of real property when the consideration paid is more than $1,000,000. While the seller pays the RTF, the buyer pays this supplemental fee of 1% of the consideration recited in the deed. If a buyer paid $1.2 million for a home, the tax they would pay at closing would be $12,000.

Capital Gains Tax

Capital gain tax is a tax on the profit from your home sale. The amount of the gain is calculated subtracting original purchase price, the value of any improvements, and transaction costs from the sale price. There are exemptions from this tax. If you have owned and occupied your current home for at least two of the last five years, typically the first $250,000 of profit for a single filer or $500,000 of profit for a married couple filing jointly is excluded. If you have not met this test you may still qualify for an exemption based on certain hardship situations that would have necessitated a sale soon after your purchase. Generally, you’re not eligible for the exclusion if you excluded the gain from the sale of another home during the two-year period prior to the sale of your home.

NJ “Exit Tax”

Commonly known as the “exit tax”, the proper name for this tax is actually “Estimated Gross Income Tax Payment Requirement for Nonresident Sellers of Real Property in New Jersey”. The exit tax is not really an exit tax but escrow of the taxes you might potentially owe on the profit from your sale. The tax was enacted in 2004 not to prevent people from leaving the state but to prevent them from leaving and not paying their state tax bill. This can negatively impact your cash flow if you need the entirety of the proceeds from your sale immediately after closing as tax payment is held until you settle your state income tax return. The amount withheld or amount withheld will be 8.97% of the profit/capital gain on the sale or 2% of the total sale price, whichever is higher. Once you file your NJ tax return, any capital gain tax you owe will be deducted from your estimated tax payment. If you sell at a loss or do not have a capital gain you will still be required to to make an estimated payment but which will be refunded after you file your NJ tax return.

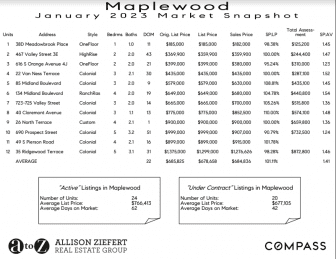

Here is our latest market report for Maplewood:

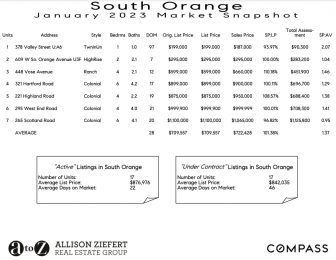

Here is our latest market report for South Orange:

Working with a real estate professional and a tax advisor can help you understand the costs involved in the sale of a home in SOMA. Do not hesitate to email me at allison@azhomesnj.com to set up a time to chat about your plans for 2023.

The Allison Ziefert Real Estate Group is a top producing real estate team based at Compass in Short Hills, NJ. We are local market experts, specializing in real estate and homes in Maplewood, South Orange, Millburn/Short Hills, Montclair/Glen Ridge, West Orange, Morristown and the surrounding NJ towns. We are driven by earning great testimonials and referral business from happy clients. You can read our reviews here.