From the Allison Ziefert Real Estate Group:

Mortgage rates have slid slightly in the last week. Competitive buyers can find a 30-year fixed rate at just under 5 percent for the first time in a number of months, but only in the best situations. Most buyers will find rates in the mid 5% range.

As is always the case though, rates fluctuate, and to see it rise again for everyone shouldn’t be a surprise.

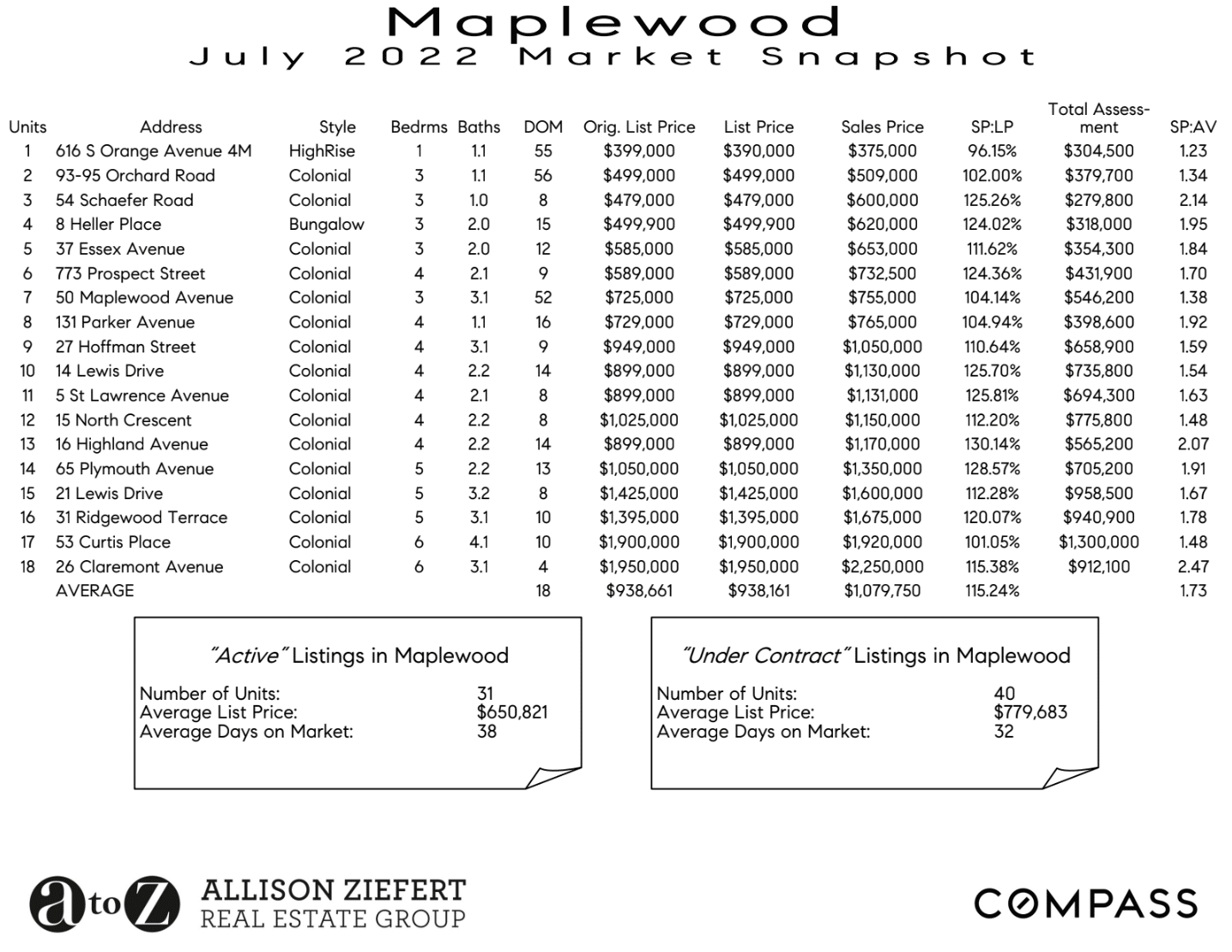

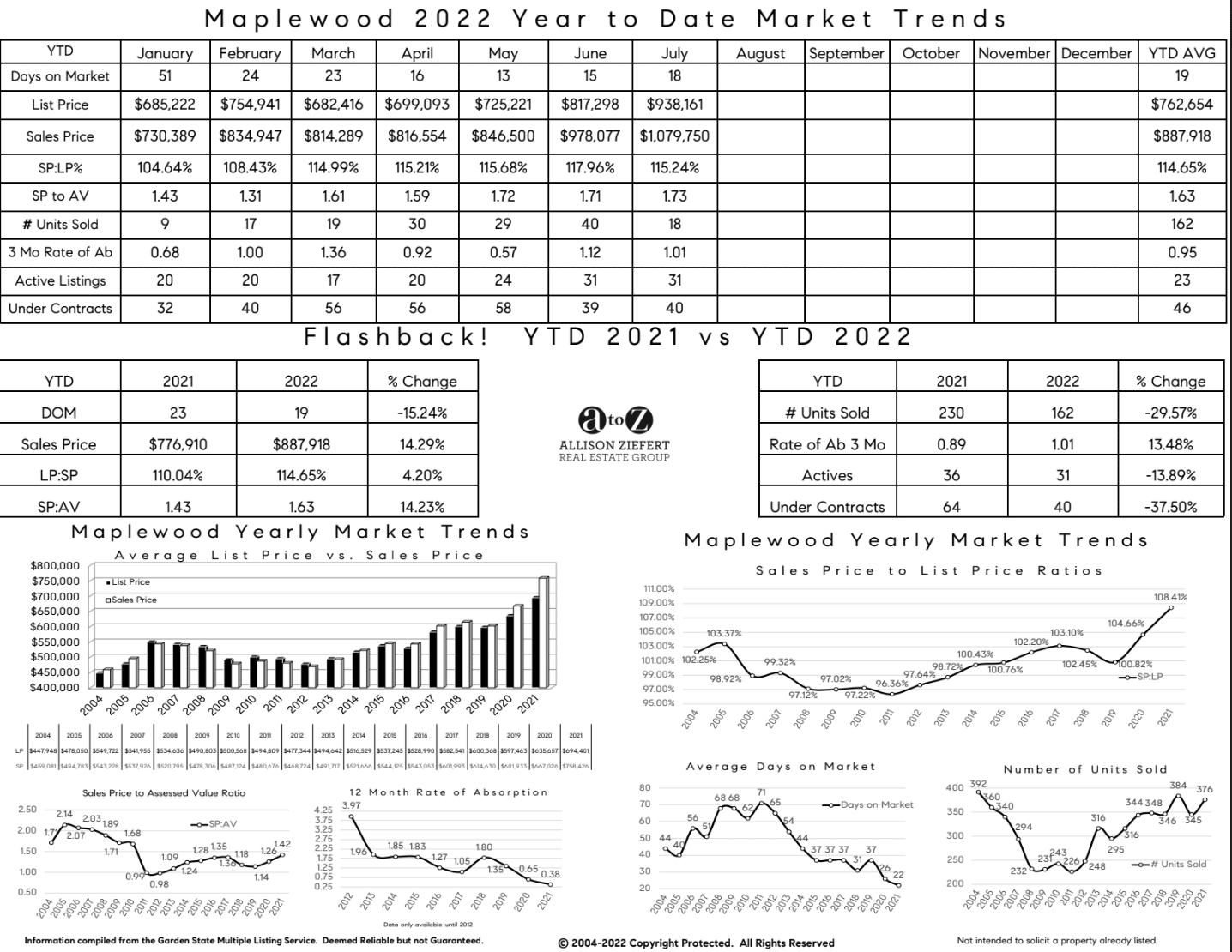

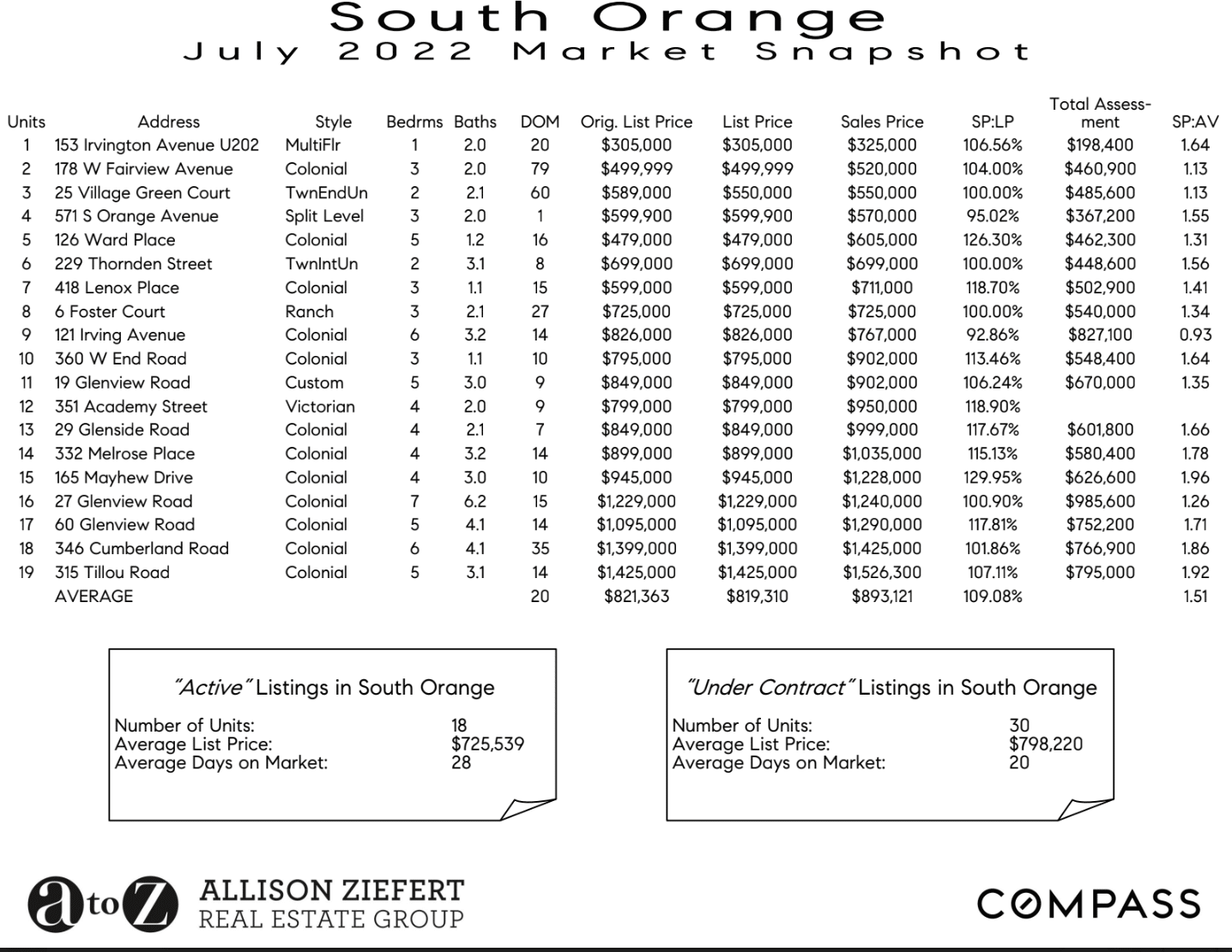

While those rates remain historically very attractive, today’s home prices don’t, even given recent drops in some markets. In SOMA, average sale prices are up over last year by over 6% in South Orange and over 14% in Maplewood. Thus, even with what many consider to be low mortgage rates, it costs a lot to buy a home in South Orange or Maplewood, begging the question, is there anything you can do to make it easier? There sure is.

Buyers use a number of tactics to achieve a lower rate when buying a home. The first and best is to be able to put more money down to reduce your financing costs. A greater down payment equates to less risk for the lender so they may be more willing to offer the lowest possible rate on that money.

Another option that buyers are considering is “buying down” their rate by paying additional lender fees upfront.

Another way to achieve a lower mortgage interest rate is to borrow for a shorter period of time. Thirty-year terms are the most common because they provide more favorable repayment terms. But, a 15-year term, again, offers the bank less risk and can result in considerably lower borrowing rates. Currently, the national average rate on a 15-year mortgage, according to Bankrate.com, is 4.82 percent. On top of that, quite frankly, 15 years is nothing in terms of home ownership. Owning a home outright is a rare thing, and 15 years would go by before you know it.

And, a trusted advisor to our team, Kyla DeMarzio of Guaranteed Rate, told us that, “Jumbo rates are trending lower than rates for conventional loans.” A jumbo loan is typically for a more expensive house requiring a loan outside of the limits set by the Federal Housing Finance Agency for repurchasing or securitization by Fannie Mae or Freddie Mac. The limit is ultimately set locally, but most of the nation has adopted $647,200, up from 2021, according to Investopedia. In our high cost area the loan limit is anything up to $970,800. These loans may come with added scrutiny on the buyer. Jumbo loans will likely require more money down on average, but they’re smart options in some markets where the average home price is creeping toward $1 million.

Many lenders now offer ARMs, or “adjustable rate mortgages,” that will remain fixed for five, seven, or ten years, for example, then adjust every six months thereafter according to market conditions. This is becoming a popular option as many buyers know they won’t stay in a house longer than that term or can refinance down the road to a fixed rate loan.

Heard of this expression: “You marry a house and date a rate”? Another pretty simple approach to saving on your mortgage is to refinance as soon as you find a more favorable rate. This would depend on the terms becoming more attractive, of course, but that’s not a stretch. If you close on your house at over five percent, anything under that will save you a measurable amount of money each month. You can shop around, too, meaning you’ll be able to take advantage of the fact that banks want your business. Now that you have a mortgage, you’re a much better candidate for a lender’s money.

Know that there are ways to make home buying more affordable, and that today’s lending practices may be strict, but they’re fair and centered on the consumer. This isn’t 2006.

Here is our latest market report for Maplewood:

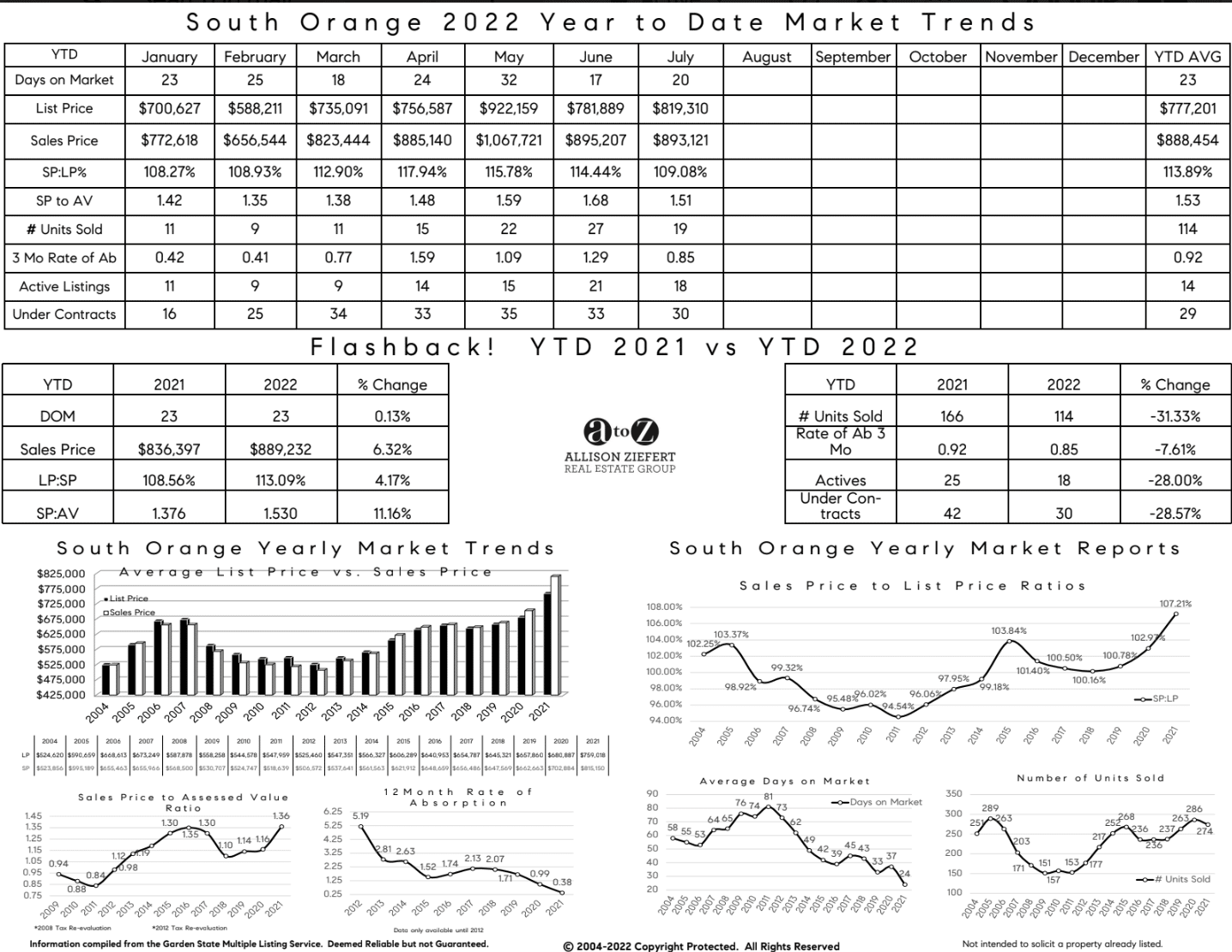

Here is our latest market report for South Orange:

As always, if you have questions about the SOMA market, buying or selling please contact us. We’d be happy to consult with you confidentially. You can email Allison at allison@azhomesnj.com to arrange a time to talk.

The Allison Ziefert Real Estate Group is a top producing real estate team based at Compass in Short Hills, NJ. We are local market experts, specializing in real estate and homes in Maplewood, South Orange, Millburn/Short Hills, Montclair, West Orange, NJ and the surrounding towns. We are driven by earning great testimonials and referral business from happy clients. You can read our testimonials here.